School Districts Benefit from HEA

February 18, 2025

By JJ Wells

Director of Homestead Exemption Analysis

In the current climate for Texas public schools, extra revenue means the difference between cutting programs or keeping them.

However, school districts may be missing out on critical revenue due to non-qualified homestead exemptions on their county appraisal district rolls. That’s why Texas school districts can benefit from homestead exemption analysis (HEA).

Nearly six million Texas households are classified as residence homesteads, granting the owners a minimum of $100,000 in property value exemption for school district property taxation purposes. But not all homestead exemptions are valid.

Invalid exemptions give an unfair benefit to some homeowners, shifting the tax burden to those who are qualified for the homestead exemption. When these erroneous exemptions are corrected, the properties can be taxed at their full appraised value, increasing the property tax revenue for school districts and other local taxing entities.

When the state legislature raised the exemption in 2023, they also mandated that appraisal districts enact proactive plans to review and verify homestead exemptions on their appraisal rolls. Linebarger’s Homestead Exemption Analysis unlocks revenue by identifying and removing invalid homestead exemptions, restoring value to the appraisal rolls and fairly applying the exemption to eligible taxpayers.

As the legislature considers increasing the homestead exemption this session, the fiscal challenge grows proportionally. A periodic review of homestead exemptions will support consistency and facilitate fairness by adding value to the tax roll.

We have a case study on how some Texas school districts benefited from HEA. For example, in 2023, Linebarger conducted an analysis of homestead exemptions for Hidalgo County Appraisal District, recommending the removal of homestead exemptions from 1,176 accounts. Our analysis revealed the potential additional taxes and interest totaled more than $4 million dollars.

For the largest school district in the county, Edinburg Consolidated Independent School District, that meant an estimated $507,533 additional tax revenue for their local schools, not considering the increased tax revenue impact from tax ceiling removals for unqualified homeowners.

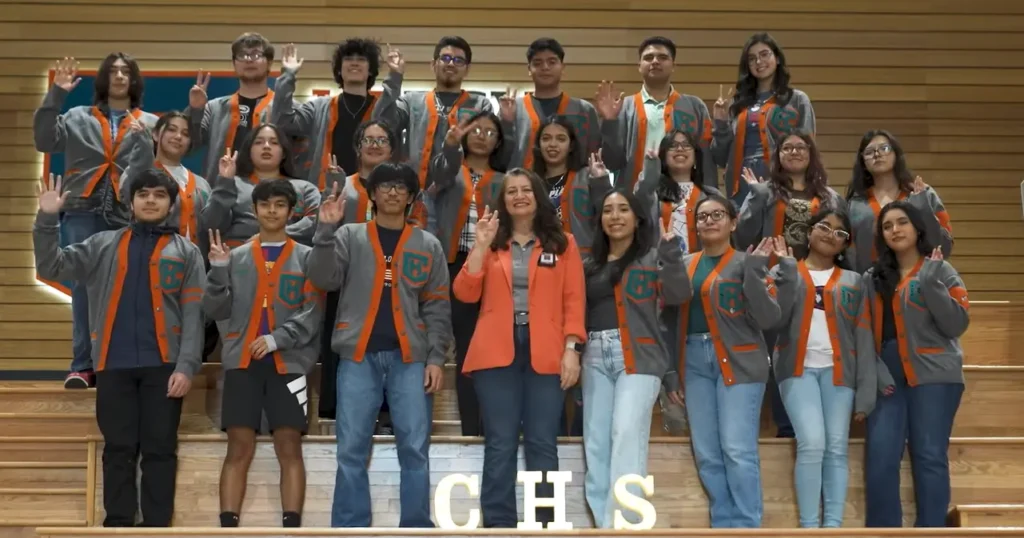

“Recovering this revenue for our district is critical to maintaining the programs for our 33,000 students across 43 campuses,” says Chief of Finance and Operations Adel Felix, CPA, CFE. “Our district is focused on providing innovative programs for our residents, from pre-K and CTE programs, to our collegiate high school where graduates can earn college credit. All of these enrichment programs take revenue and it’s important that we have a sustainable way to continue to provide for our future citizens.”

For smaller districts in Hidalgo County, our HEA process revealed critical potential revenue for Sharyland Independent School District, up to $88,259. With 13 schools and less than 10,000 students, the district carefully weighs adding programs based on incoming revenue.

“As a small district, this amount of additional revenue can mean the difference in expanding programs and enrichment activities. Our students have unique challenges and additional dollars makes it possible to meet each child’s needs,” says Jaime Ortega, Sharyland ISD Chief Financial Officer.

With school finance officers looking at innovative ways to balance their budgets, it’s important that they fully capture the primary source of revenue available to them – property taxes. Texas school districts can benefit from the HEA process.

Linebarger has been conducting Homestead Exemption Analysis since 2012, adding $39 million in revenue for local taxing entities. It’s one reason counties like Hidalgo have turned to Linebarger for assistance in updating their appraisal and tax rolls.

“We’ve found the homestead exemption analysis provided by Linebarger to be worth the time and fees we spend conducting the review,” says Paul Villarreal, Hidalgo County Tax Assessor-Collector. “The insights we have gained have given us confidence that our property tax assessment is done fairly for all taxpayers.”

Linebarger’s process has delivered the potential for millions of dollars in additional tax revenue to local school districts, supporting the idea that Texas school districts can benefit from the HEA process.

If you would like more information on Linebarger’s HEA process, reach out to your local Linebarger office, or you can contact me at [email protected].

This content is intended and provided solely for educational and/or informational purposes. It is not intended to provide legal advice, nor does your receipt of this content create an attorney-client relationship. This content is not a substitute for the specific legal advice of an attorney licensed in your jurisdiction.

If you are a current or prospective client this content may be subject to the attorney-client privilege or the attorney work product privilege or otherwise be confidential. Any dissemination, copying or use of this content by or to anyone other than the designated and intended recipient(s) is unauthorized.